Overview

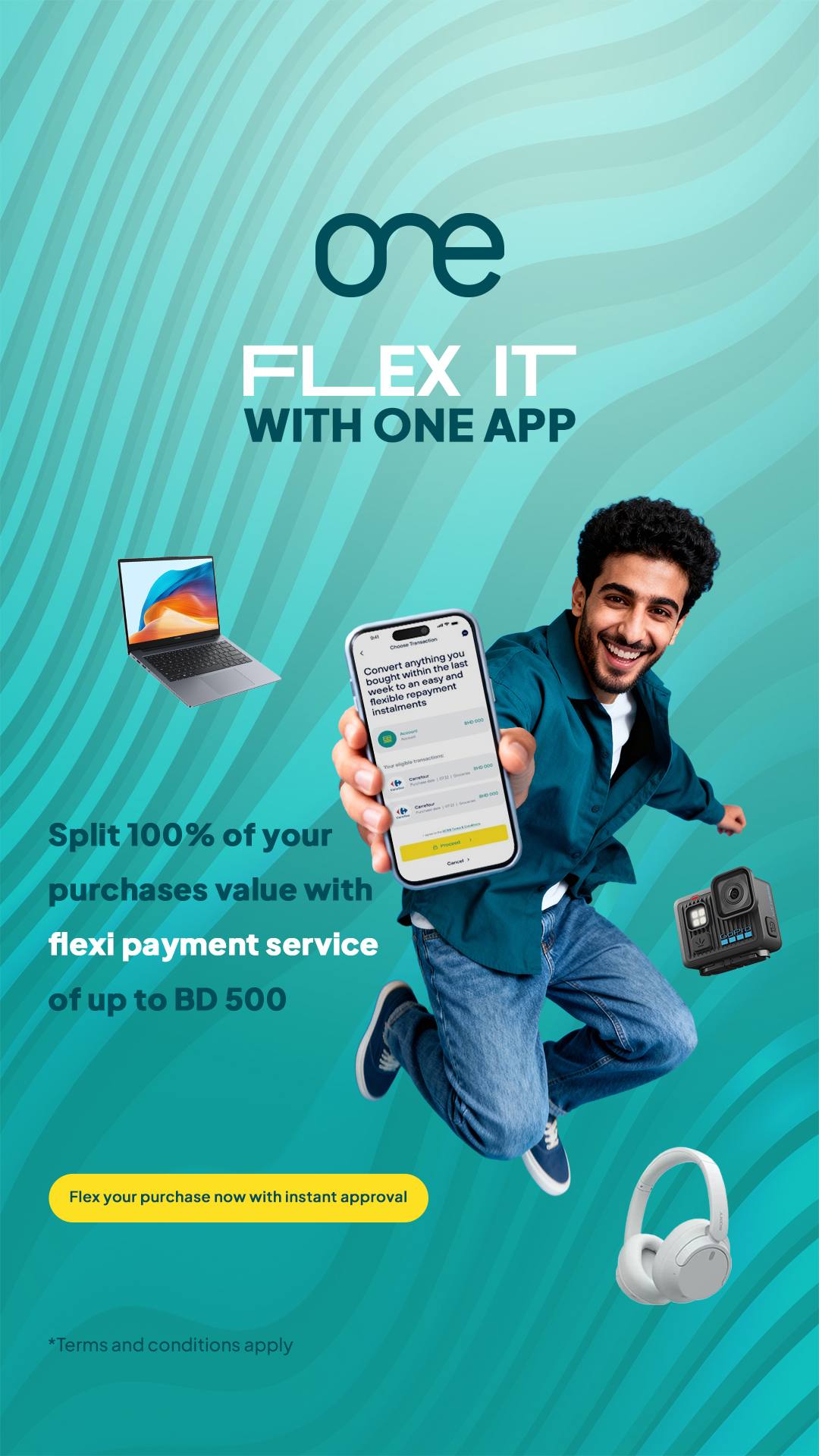

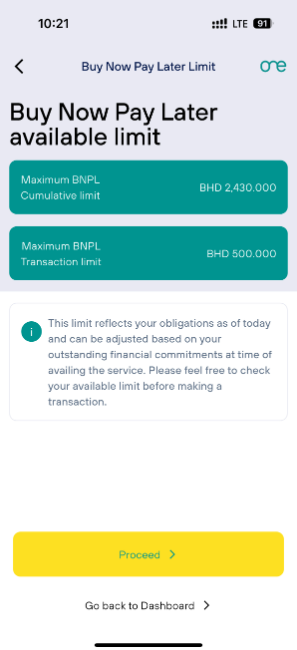

The Flexi Payment service via ONE App in Bahrain offers a smart and seamless way to manage your past debit card Purchases with more flexibility. Instead of bearing the burden of paying large purchases all at once, you can now Flix any eligible debit card Purchase into three easy monthly instalments with instant approval, no paperwork, and coverage of up to BD 500 per purchase.

How does Flexi Payment works?

Fast, digital, and designed to give you flexibility and control over your payments anytime, anywhere in Bahrain.

Why use Flexi Payment from ONE App?

Why use the “Flexi Payment” service from ONE App?

✔ Flex your purchases made with your debit card into three easy installments via ONE app

✔ Manage your spending with more control and flexibility

✔ Get instant approval no paperwork, no delays

✔ Turn 100% of your purchases value into flexible installments of up to BD 500

✔ Works with any Bahraini debit card and any local or international merchant

✔ Flat service fee of BD 10 + VAT no hidden charges

✔ Fully digital experience, right inside ONE App

FAQs

Flexi Payment is a feature within ONE App that allows you to Flix eligible past debit card Purchases into 3 easy monthly instalments quickly, securely, and fully digitally.

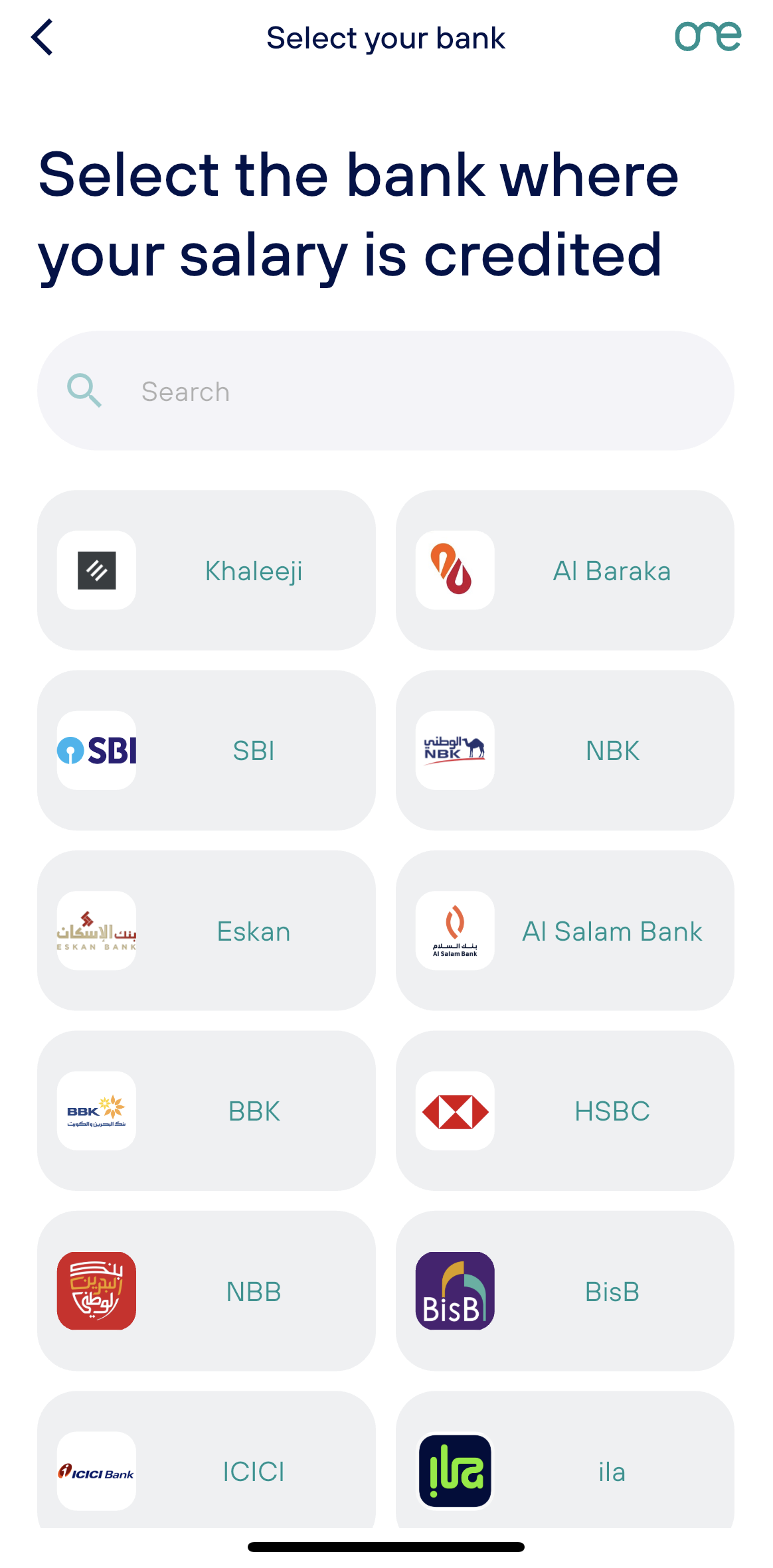

The service is available to salaried Bahrainis and salaried expats residing in Bahrain who are registered users of ONE App.

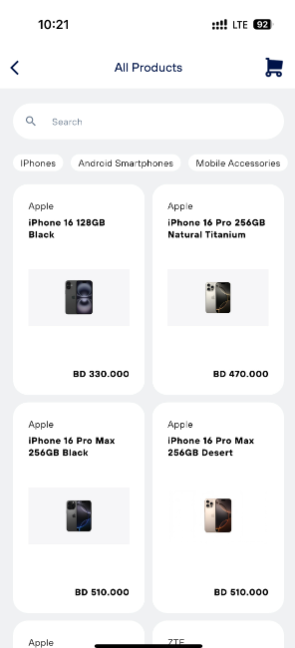

You can Flix any eligible past debit card Purchase, made at any merchant (local or international), using any Bahraini bank debit card, provided it’s within the approved amount limit.

Turn 100% of your purchases value into flexible installments of up to BD 500

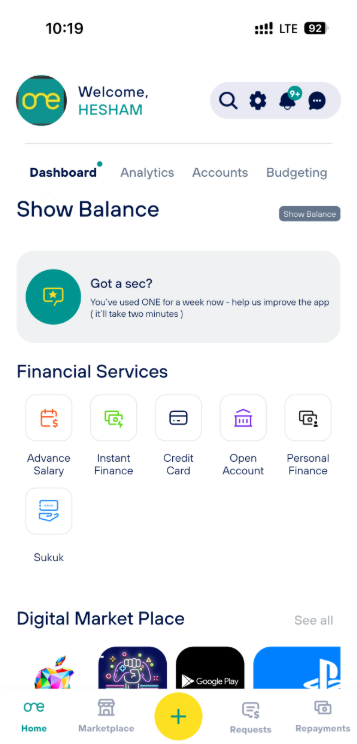

- Open ONE App

- Select “Flexi Payment” from the main menu

- Select the desired account

- Choose the Purchase you want to Flix

- Confirm and receive instant approval

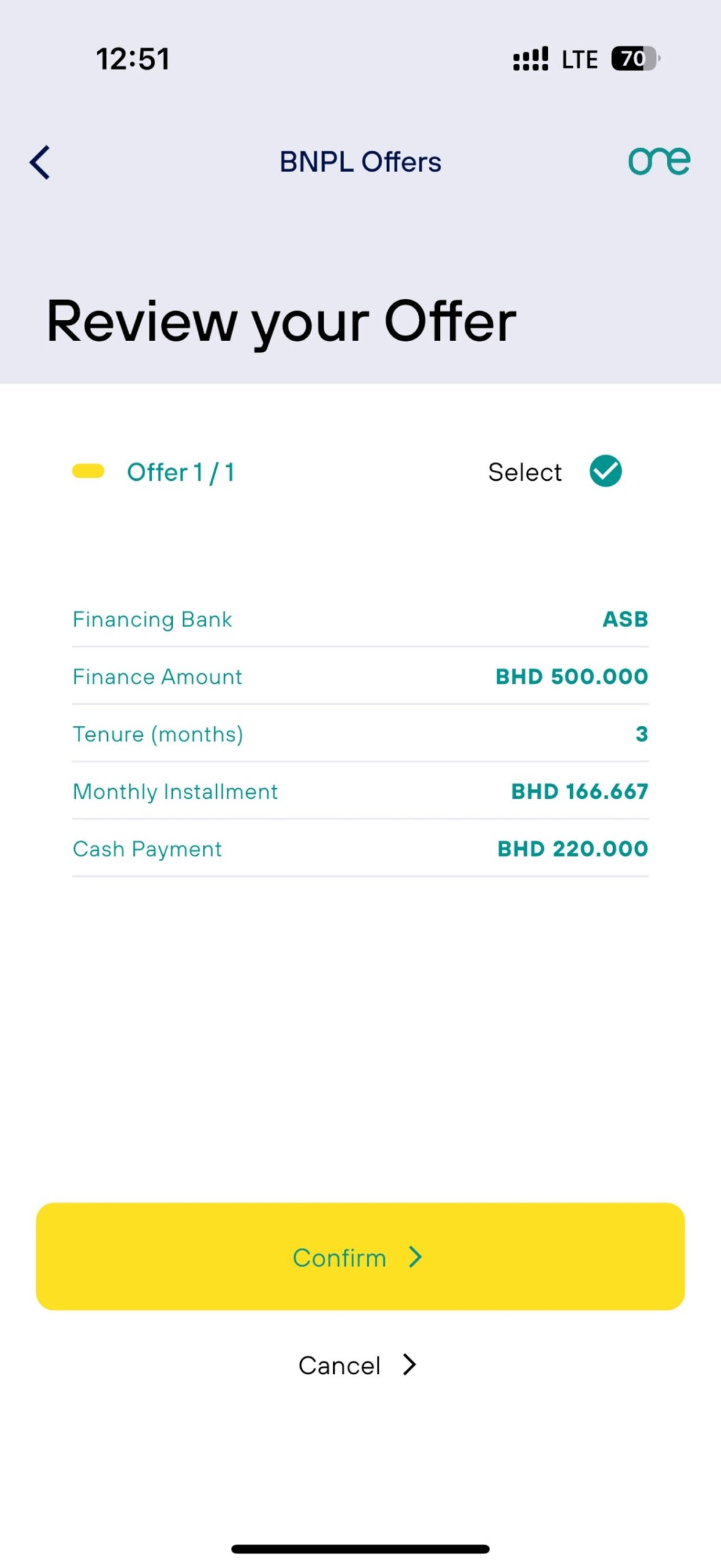

Yes, a flat service fee of BD 10 + VAT applies per Flexi Payment request with no hidden charges.

All Flexi Payment plans are divided into 3 monthly instalments.

Not at all. The entire process is 100% digital with no paperwork or branch visits required.

Yes, the service is designed to align with Sharia-compliant financing principles.